3 Reasons to Add Case Studies to Your Website - YFCD #38

Building trust through copywriting, getting featured in publications

Welcome back,

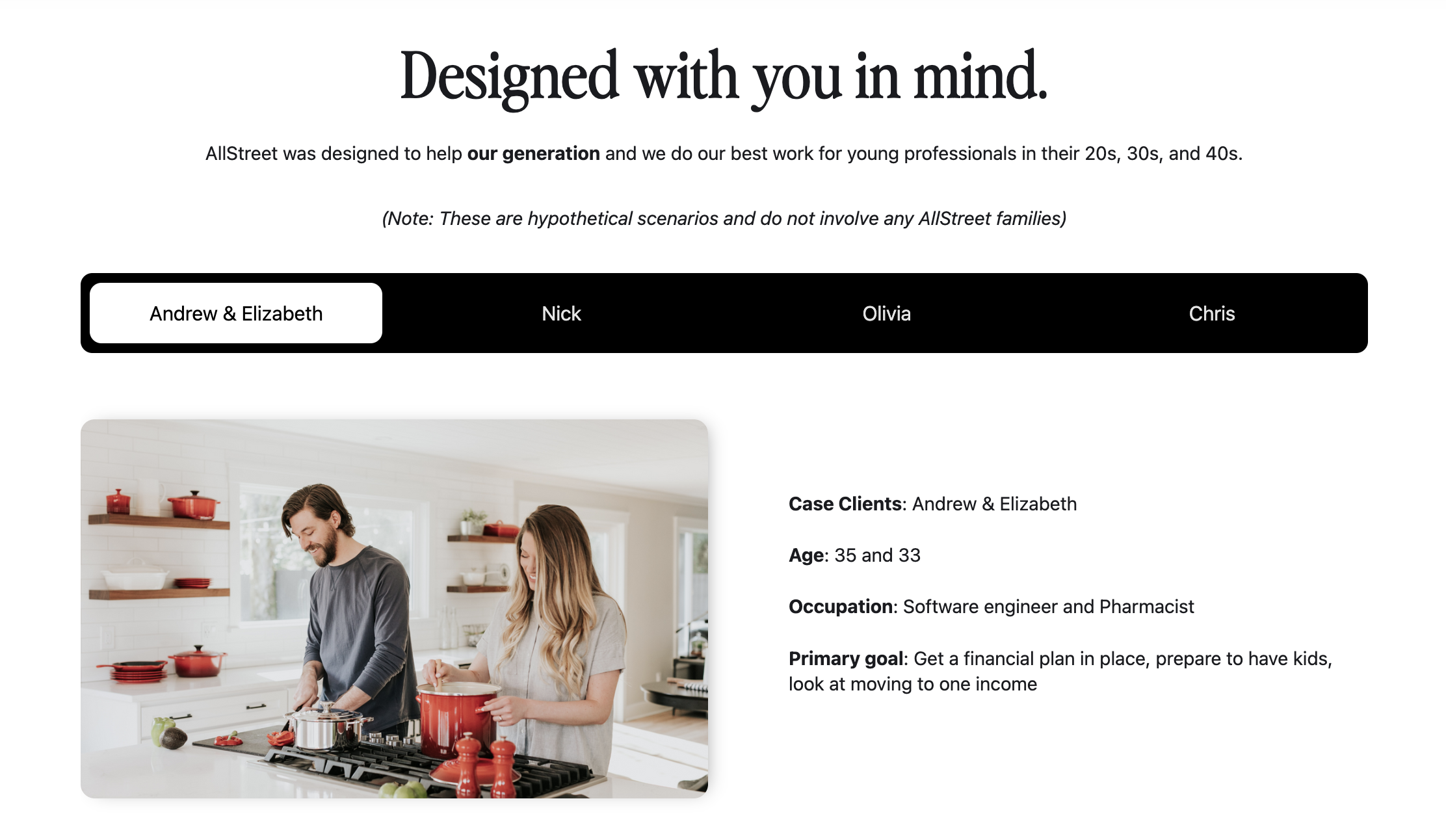

I've included case studies on my financial planning website since it launched in 2020.

With a brief background in door-to-door sales, I knew that I wanted to do everything I could to make the sales process easier & sell the service through the website language.

When knocking doors, you quickly learn that you can't sell everything to everyone.

In my situation of selling security systems, there were a few types of ideal clients:

- People with an existing security system

- People who just moved

- People starting a family

Every sale I made was to someone that fell into one of those three buckets.

If I had my own security system company, I would highlight those three profiles on my website, write a background about their situation, and show how my system is the best choice for them.

So I did the same thing for the financial planning firm.

And I would say it's worked extremely well.

Prospective clients have referenced them on discovery calls and because we define our ideal clients, those are the exact kinds of people who reach out to us.

So today, I want to break down a few reasons why I think every firm should include case studies:

1) Ideal clients self-select

A lot of advisors are scared to niche down. And it makes sense. A full-blown niche isn't right for everyone. But you should have a general sense of what stages of life you serve best or enjoy working with, problems they have, or goals they want to accomplish.

Regardless of career, you can write a short case study to show common situations people are in when it makes sense to work with an advisor, and explain how the service you provide solves their problems.

You'll not only get higher quality inbound leads, you'll probably get more of them because someone can actually see what working with a financial advisor looks like & the value they'd get.

2) Showcases real financial planning

Most people don't really know what we do as financial advisors. Through case studies, you can describe an ideal client's situation, background, and financial problems.

Then, you can explain the different tasks & planning areas you'd address if they were clients so someone can start to understand the art of real planning.

3) Can replace a "list of services"

A majority of advisor websites I come across are almost identical. The names are different, but the copywriting could be switched around to different sites and nobody would notice.

And one of the biggest missed opportunities I see is describing the actual service of financial planning.

Similar to the point above, few people understand what "college planning" or "insurance planning" truly means. But when they're described in context, someone can start to imagine how the service would make an impact in their life - like these examples from our case studies:

- Insurance planning = "Life insurance analysis to make sure their family was protected against events that could drastically hurt their financial picture"

- College planning = "College savings plan for kids & utilizing the best accounts for flexibility and taxes, came up with a plan to refinance her private student loans since they were high interest and showed her how much to pay towards them every month"

Next week, I'm going to share more about how to write effective case studies for your website along with tangible examples.

How I Would Improve This Twitter Ad (in 3 Minutes)

Below is a random ad I saw this past week from an advisor in Texas:

I don't think I've ever seen an RIA run a twitter ad before. And at first glance, without knowing how well it's performing, I have a few thoughts.

But first, here's my 3-minute attempt at rewriting the copy to capture more attention:

Ready to retire?

Don't let an exciting new chapter turn into a financial nightmare 💰

We help couples with $xxx,xxx confidently turn the page into retirement - see how:

Twitter has a limited character count so you can't go too in-depth, but you can still speak to an ideal client. Calling out "ready to retire?" right away speaks to a specific time in someone's life, and then further narrows the audience through defining an asset minimum (or however you'd qualify clients).

Also, spacing out the text helps with readability (and takes up more of the twitter feed) compared to a standard paragraph.

Once someone clicks the ad link, the landing page itself should have a call-to-action button visible, and the content should be properly formatted amongst the hero section - unlike the current version below:

Instead of only asking people to schedule a call, I would run another ad with some form of free resource that's valuable enough for someone to click & download (in this scenario, I think a retirement checklist would work well). Then, you can continue marketing to them & educating about the value of financial planning through email. Over time, you'll have hopefully built up enough trust that they feel comfortable scheduling a call & working together.

Club:Curated

Read: Everything You Need to Know About Media & Publication Features (as a Financial Advisor)

Edit: A Checklist to Maximizing Employee Benefits (as a Tech Professional)